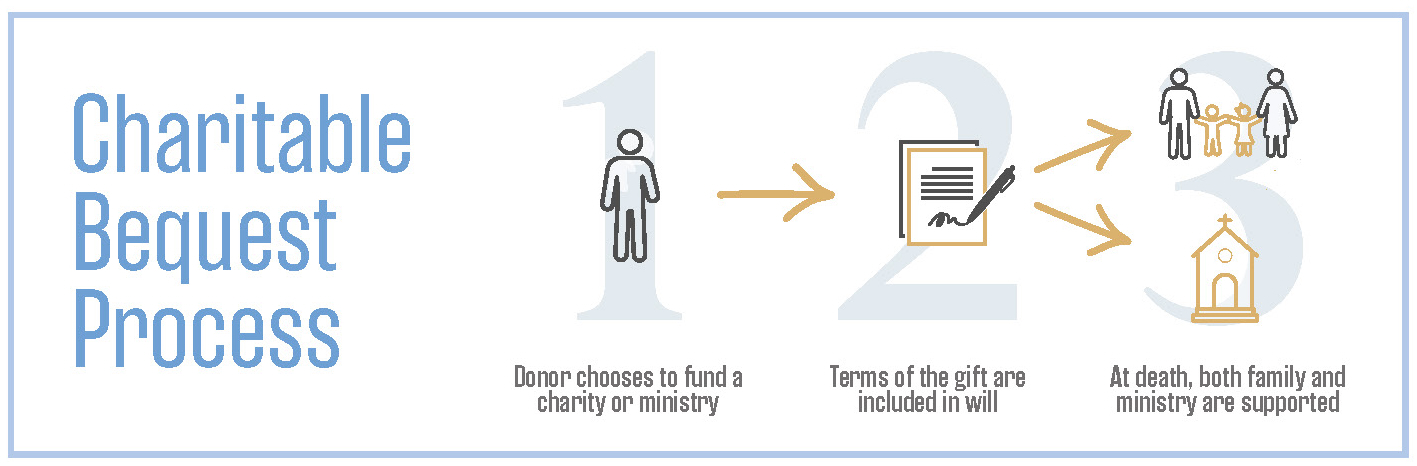

At Georgia Baptist Foundation, we believe that God calls each of us to be faithful stewards of the resources He has entrusted to us, understanding that everything we have ultimately belongs to Him. As part of this stewardship, planning for the future is essential. One of the simplest and most impactful ways to support the ministries and causes you are passionate about is by including a charitable bequest in your will or estate plan. A bequest allows you to designate a specific gift of money, property, or other assets to support your chosen ministry. This ensures that your legacy of generosity continues beyond your lifetime, providing meaningful support to the work of the Kingdom. By planning ahead, you can bless future generations while remaining a faithful steward of God’s blessings.

Leave a Lasting Legacy. A charitable bequest is the simplest way to leave a meaningful legacy that supports the ministry or cause you’re passionate about. It allows you to make a significant impact while ensuring your values endure for generations.

Maintain Control and Flexibility. With a charitable bequest, you retain control of your assets during your lifetime. This allows you the flexibility to modify your gift as your circumstances or preferences change, ensuring your wishes are met.

Reduce Taxes and Maximize Impact. Strategic planning enables you to direct gifts from taxable estate assets, such as retirement accounts. This reduces the tax burden on heirs and ensures that more of your estate supports causes you care about, rather than going to taxes.

Sally and John wanted their faith to leave a lasting impact. They added a charitable bequest to their estate plan by naming their church as a beneficiary of John’s retirement account. After their lifetime, the remaining funds will transfer directly to the church—tax-free—bypassing probate and maximizing the gift’s value. This simple beneficiary designation ensures their church receives steady support for ministry, missions, and future generations. Their legacy of generosity will continue long after they’re gone.

Sally and John wanted their faith to leave a lasting impact. They added a charitable bequest to their estate plan by naming their church as a beneficiary of John’s retirement account. After their lifetime, the remaining funds will transfer directly to the church—tax-free—bypassing probate and maximizing the gift’s value. This simple beneficiary designation ensures their church receives steady support for ministry, missions, and future generations. Their legacy of generosity will continue long after they’re gone.

Start An Irrevocable Gift Agreement

No pressure — just explore what fits your season of life.