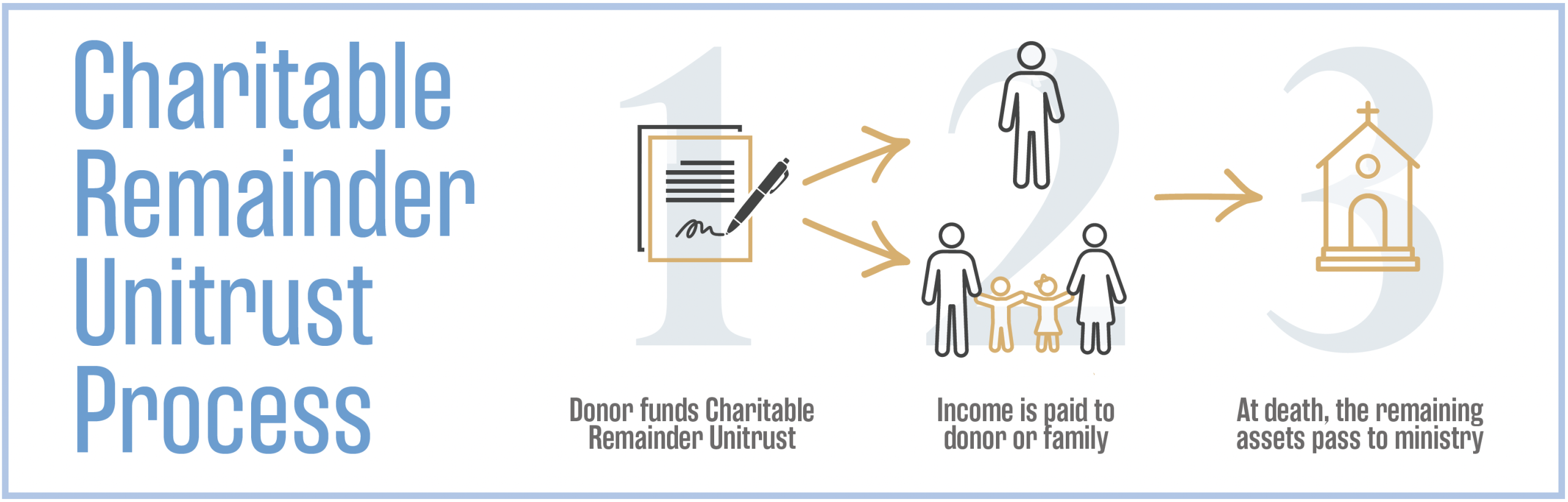

A Charitable Remainder Unitrust is a planned giving tool that pays an income to one or more beneficiaries for life or for a term of years, with the remaining value eventually going to ministry.

You contribute cash or appreciated assets to the trust, receive an immediate charitable deduction for a portion of the value, and the trust pays a fixed percentage of its value to you or loved ones each year.

Because the trust itself is generally tax-exempt, appreciated assets can often be sold and reinvested inside the CRUT without immediate capital gains tax, providing diversification and potential growth.

At the end of the trust term, whatever remains passes to the ministries you have named, creating a significant future gift for Gospel impact.

AVOID CAPITAL GAINS TAX.

RECEIVE A TAX DEDUCTION.

RECEIVE LIFETIME OR FIXED-TERM INCOME. A CRUT provides income for you, your spouse, or beneficiaries for life or up to 20 years. It offers financial security while ensuring that remaining funds ultimately support your chosen charitable organizations.

Steve and Melissa invested in residential rental property for over 20 years. They decide to reduce the burden of managing the properties but because of the depreciated value they are hesitant to sell the property due the capital gains tax. Instead, they decide to gift some of the rental properties into a CRUT which allows them to save on the capital gains tax, receive the income they need, and support their favorite global missions ministry.

Steve and Melissa invested in residential rental property for over 20 years. They decide to reduce the burden of managing the properties but because of the depreciated value they are hesitant to sell the property due the capital gains tax. Instead, they decide to gift some of the rental properties into a CRUT which allows them to save on the capital gains tax, receive the income they need, and support their favorite global missions ministry.

Start An Irrevocable Gift Agreement

No pressure — just explore what fits your season of life.