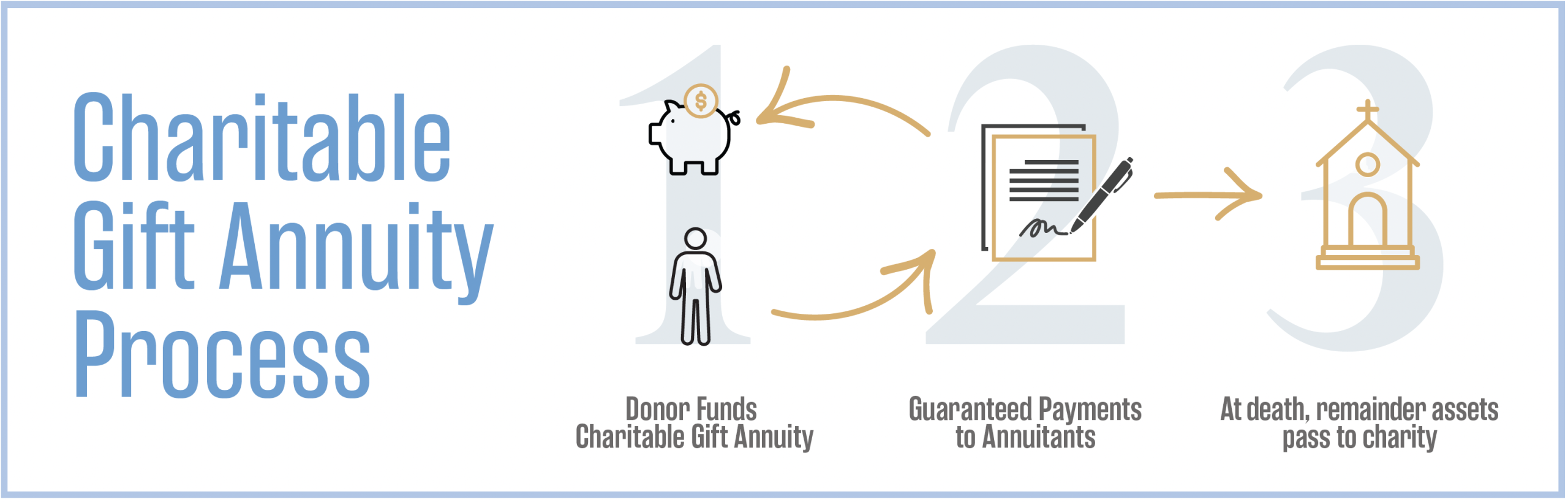

Charitable Gift Annuity (CGA) offers a flexible and strategic way to support the causes you care about while securing a reliable income stream for life. This giving vehicle can be funded using various assets, including cash, stocks, or other appreciated securities. Your fixed income payments are determined by your age at the time of the gift, providing financial stability. If funded with cash or similar assets, you may qualify for a charitable tax deduction in the year of your contribution. If funded with appreciated assets, you may bypass capital gains tax. Upon your passing, the remaining funds will support the ministries of your choice or establish a perpetual endowment for lasting Kingdom impact.

ENJOY A TAX DEDUCTION. Receive a charitable income tax deduction in the year of your gift, reducing your tax liability. This deduction provides immediate financial benefits while allowing you to support the causes that matter most to you, maximizing both your charitable impact and tax savings.

GUARANTEED PAYMENTS BASED ON YOUR AGE. Your annuity payments are determined by your age at the time of the gift, ensuring a reliable income stream for life. The older you are, the higher the payment rate, offering a predictable and steady source of income in retirement.

POTENTIAL TAX-FREE PAYMENTS. A portion of your annuity payments may be tax-free, and any taxable amount could be subject to lower capital gains tax rates, offering further financial advantages. This strategy can help reduce your overall tax burden and increase your financial flexibility.

Mr. Scott, aged 82, decides to fund a Charitable Gift Annuity (CGA) by donating appreciated stock, allowing him to avoid the capital gains tax he would have incurred if he had sold the stock. In return for his gift, Mr. Scott will receive an annual fixed income of 7.7% of the initial trust value, providing him with financial security for the rest of his life. The CGA guarantees these payments, offering a steady income stream. Upon his passing, the remaining balance in the trust will be used to establish a perpetual endowment to benefit his church, ensuring that his gift continues to support his faith community for years to come. This arrangement allows him to combine tax benefits with charitable giving.

Mr. Scott, aged 82, decides to fund a Charitable Gift Annuity (CGA) by donating appreciated stock, allowing him to avoid the capital gains tax he would have incurred if he had sold the stock. In return for his gift, Mr. Scott will receive an annual fixed income of 7.7% of the initial trust value, providing him with financial security for the rest of his life. The CGA guarantees these payments, offering a steady income stream. Upon his passing, the remaining balance in the trust will be used to establish a perpetual endowment to benefit his church, ensuring that his gift continues to support his faith community for years to come. This arrangement allows him to combine tax benefits with charitable giving.

Start An Irrevocable Gift Agreement

No pressure — just explore what fits your season of life.