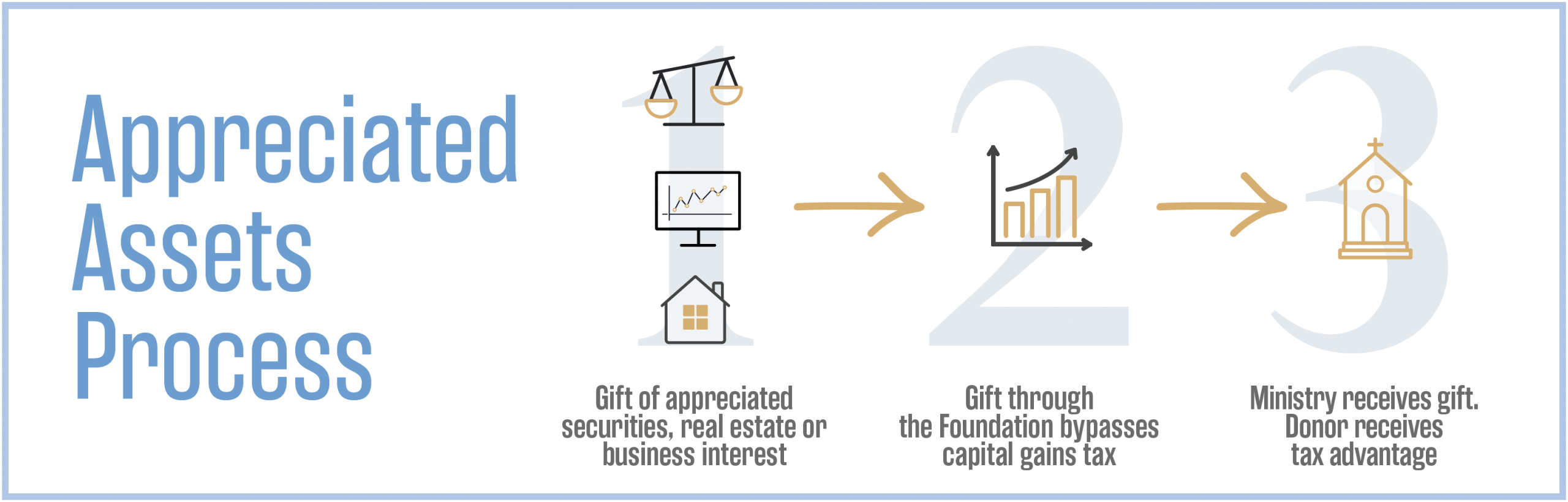

Many donors hold appreciated assets such as publicly traded stock, mutual funds, real estate, or closely held business interests.

When you sell these assets outright, a significant portion of the gain may be lost to taxes. Giving them directly to ministry can be far more efficient.

By donating appreciated assets before a sale, you may avoid capital gains tax, receive a charitable deduction for the fair market value (subject to IRS rules), and increase what ultimately supports Kingdom work.

The Georgia Baptist Foundation can help you evaluate which assets are appropriate for charitable giving and structure gifts to benefit both ministry and your financial goals.

AVOID CAPITAL GAINS TAX.

CHARITABLE DEDUCTION WITH CARRYOVER. Your donation may qualify for a tax deduction based on fair market value. Any excess deduction can be carried forward for up to five years.

INCREASE GIVING POTENTIAL UP TO 20%.

Start An Irrevocable Gift Agreement

No pressure — just explore what fits your season of life.