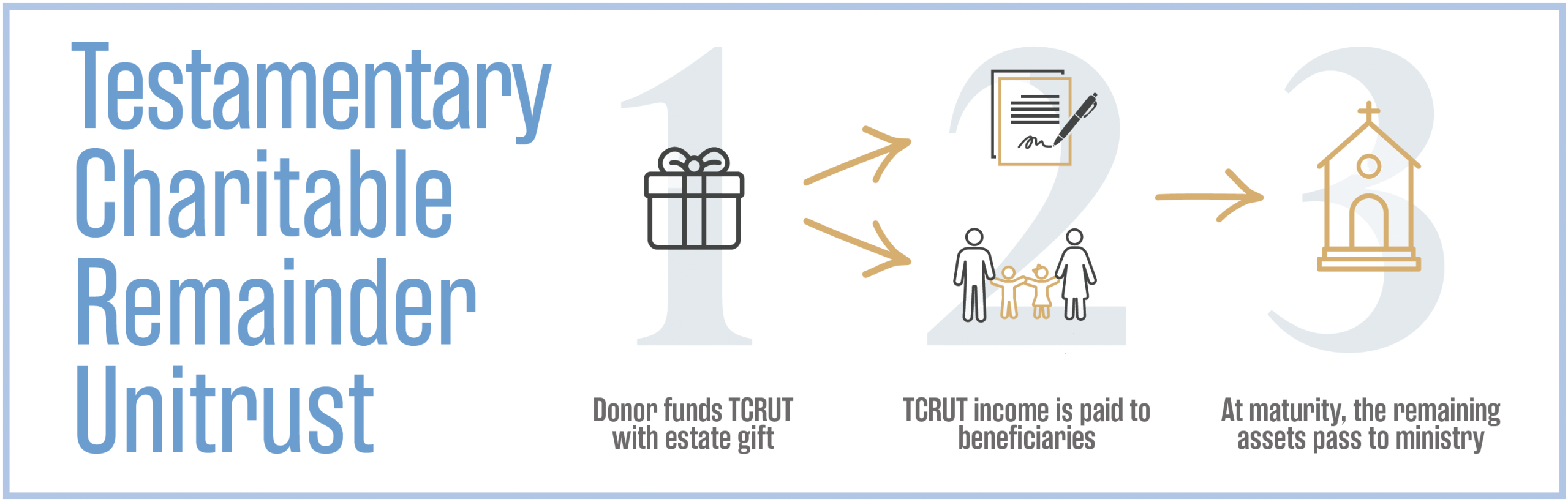

A Testamentary Charitable Remainder Unitrust is a CRUT that is created at your death according to instructions in your will or revocable trust.

Instead of passing certain assets directly to heirs, those assets fund the TCRUT, which then pays income to your chosen beneficiaries for life or for a term of years.

At the end of the trust term, the remaining value passes to ministry, providing a final and meaningful expression of your faith and generosity.

This tool can be especially helpful when you want to provide long-term income to family members while also ensuring that significant support flows to Gospel work.

STRUCTURED INHERITANCE DISTRIBUTION. A TCRUT allows you to distribute an inheritance gradually, ensuring your heirs receive financial support over time rather than a lump sum. This approach helps provide long-term stability and financial management for your loved ones.

INCOME FOR UP TO 20 YEARS. Your children or other designated beneficiaries can receive reliable income payments from the trust for up to 20 years. This structured payout helps protect their financial well-being and ensures they benefit from your estate over an extended period.

SUPPORT FOR MINISTRY AFTER THE TRUST ENDS. Once the income distribution period concludes, the remaining trust assets are directed to support ministry efforts. These funds can be given as a one-time gift or used to establish a perpetual endowment, creating a lasting impact.

Start An Irrevocable Gift Agreement

No pressure — just explore what fits your season of life.